Living in El Cajon, a city that thrives on community spirit and personal growth, provides the perfect backdrop for setting and achieving personal goals. Whether you’re looking to enhance your career, improve your health, or develop a new skill, the journey begins with a clear and actionable plan. Setting personal goals is more than just jotting down aspirations; it’s about creating a roadmap that guides you through the steps needed to turn dreams into reality. This guide will walk you through the essential steps of goal-setting, offering practical tips to help you stay focused and motivated, no matter the obstacles. By understanding the principles of effective goal-setting, you can harness the energy and resources available in El Cajon to achieve your personal aspirations.

Setting and Achieving Personal Goals: A Guide for El Cajon Residents

Setting and achieving personal goals is a transformative process that can bring about significant changes in your life. Whether you're aiming to enhance your career, improve your health, or develop a new skill, the journey begins with clear, actionable goals. This guide will walk you through the essential steps of goal-setting, offering practical tips to help you stay focused and motivated. By understanding the principles of effective goal-setting, you can harness your potential and achieve your aspirations.

The Foundation of Goal Setting

Setting personal goals starts with understanding what you truly want to achieve. This requires introspection and a clear vision of your desired outcomes. Begin by reflecting on different areas of your life, such as career, health, relationships, and personal development. Identify what matters most to you and where you see yourself in the future. This initial step is crucial because it helps you align your goals with your core values and long-term vision.

Once you've identified your primary areas of focus, it's time to define your goals. Effective goals are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Specific goals provide a clear direction and avoid ambiguity. For instance, instead of saying "I want to be healthier," specify the actions, like "I want to lose 10 pounds in three months by exercising regularly and eating a balanced diet." Measurable goals allow you to track your progress and stay motivated. Achievable goals should be realistic and within your capabilities. While it's important to challenge yourself, setting unattainable goals can lead to frustration. Relevant goals align with your broader life objectives, ensuring that your efforts contribute to your overall vision. Lastly, time-bound goals have a deadline, creating a sense of urgency and helping you prioritize your tasks.

Writing down your goals is a powerful practice that makes them tangible. Studies have shown that individuals who write down their goals are more likely to achieve them. Use a journal, planner, or digital tool to document your goals, and review them regularly to stay focused and motivated. Additionally, sharing your goals with a trusted friend, family member, or mentor can provide accountability and support.

Strategies for Achieving Your Goals

With your goals clearly defined, the next step is to develop a plan of action. Break down each goal into smaller, manageable tasks. This approach, known as chunking, helps you avoid feeling overwhelmed and makes the process more manageable. For example, if your goal is to write a book, break it down into tasks such as researching your topic, creating an outline, writing a chapter each month, and so on. Each task should have a deadline to ensure steady progress.

Time management is critical when working towards your goals. Create a schedule that allocates specific times for each task, and stick to it as closely as possible. Prioritize your tasks based on their importance and deadlines. Using tools like calendars, to-do lists, and productivity apps can help you stay organized and focused. Remember to build in some flexibility for unexpected events or challenges that may arise.

Staying motivated is one of the biggest challenges in achieving personal goals. It's normal to experience periods of low motivation or setbacks. To keep your motivation levels high, regularly remind yourself of the reasons behind your goals and the benefits of achieving them. Visualize your success and the positive impact it will have on your life. Celebrate your progress and milestones, no matter how small they may seem. Rewards can be a great motivator, so treat yourself to something special when you reach a significant milestone. Another effective strategy is to cultivate a growth mindset. This mindset, developed by psychologist Carol Dweck, emphasizes the belief that abilities and intelligence can be developed through dedication and hard work. Embrace challenges, learn from criticism, and persist in the face of setbacks. A growth mindset fosters resilience and helps you view failures as opportunities for learning and growth.

Overcoming Challenges and Staying on Track

Achieving personal goals often involves overcoming obstacles and setbacks. It's important to anticipate potential challenges and develop strategies to address them. Common obstacles include procrastination, fear of failure, lack of resources, and external distractions. Identifying these challenges in advance allows you to create a proactive plan to tackle them.

Procrastination is a common hurdle that can derail your progress. To combat procrastination, break tasks into smaller steps and set specific deadlines. Use techniques like the Pomodoro Technique, which involves working for 25 minutes and then taking a 5-minute break, to maintain focus and productivity. Additionally, eliminate distractions by creating a dedicated workspace and limiting interruptions. Fear of failure can also hinder your progress. It's natural to feel apprehensive about stepping out of your comfort zone, but remember that failure is a part of the learning process. Reframe your perspective on failure by viewing it as an opportunity to gain valuable insights and improve your approach. Surround yourself with a supportive network of friends, family, and mentors who can offer encouragement and constructive feedback.

Lack of resources, whether it's time, money, or knowledge, can be a significant barrier. Address this challenge by seeking out resources and support. This might involve taking a course, attending workshops, seeking mentorship, or finding ways to manage your time more effectively. Sometimes, being resourceful and creative can help you find solutions to seemingly insurmountable problems. External distractions, such as social media, can also disrupt your focus. Set boundaries by scheduling specific times for checking emails and social media. Consider using apps that block distracting websites during work periods. Creating a conducive environment for productivity, free from unnecessary distractions, can significantly enhance your ability to stay on track.

As you work towards your goals, it's essential to regularly assess your progress. Periodic evaluations allow you to determine whether you're on track and make necessary adjustments to your plan. Reflect on what's working well and what needs improvement. Be open to adapting your approach based on your experiences and changing circumstances.

In addition to self-assessment, seeking feedback from others can provide valuable insights. Share your progress with a trusted friend, mentor, or coach who can offer objective feedback and guidance. Constructive feedback can help you identify blind spots and refine your strategies for achieving your goals.

Persistence is a key factor in achieving long-term goals. There will inevitably be moments of doubt and discouragement, but staying committed to your vision is crucial. Remind yourself of your "why" – the underlying reason for pursuing your goals. Reconnecting with your motivation can reignite your determination and keep you moving forward. Developing healthy habits that support your goals is another effective strategy. Habits are powerful tools that can automate positive behaviors and make it easier to stay on track. For example, if your goal is to improve your fitness, establish a daily exercise routine that becomes a non-negotiable part of your day. Consistency is key to turning actions into habits that propel you towards your goals.

Embrace and Enjoy the Journey

Setting and achieving personal goals is a journey that requires dedication, perseverance, and a willingness to learn and adapt. It's a process that can transform your life and lead to significant personal growth. Remember that progress may not always be linear, and setbacks are a natural part of the journey. Embrace these challenges as opportunities to learn and grow.

Celebrate your successes along the way, no matter how small they may seem. Each step forward is a testament to your commitment and effort. Surround yourself with a supportive community that encourages and uplifts you. Share your goals and progress with others, and offer support to those who are on their own journeys. As you achieve your goals, you'll not only experience a sense of accomplishment but also inspire those around you. Your dedication and determination can serve as a source of motivation for others to pursue their own dreams. By setting and achieving personal goals, you contribute to a culture of growth and achievement in your community.

The journey of setting and achieving personal goals is a powerful tool for personal transformation. It begins with a clear vision and well-defined goals, followed by a strategic plan of action and a commitment to perseverance. Along the way, you'll develop resilience, adaptability, and a growth mindset that will serve you in all areas of life. So, take the first step today, set your sights high, and embark on a journey of growth, achievement, and fulfillment. Your future self will thank you for it.

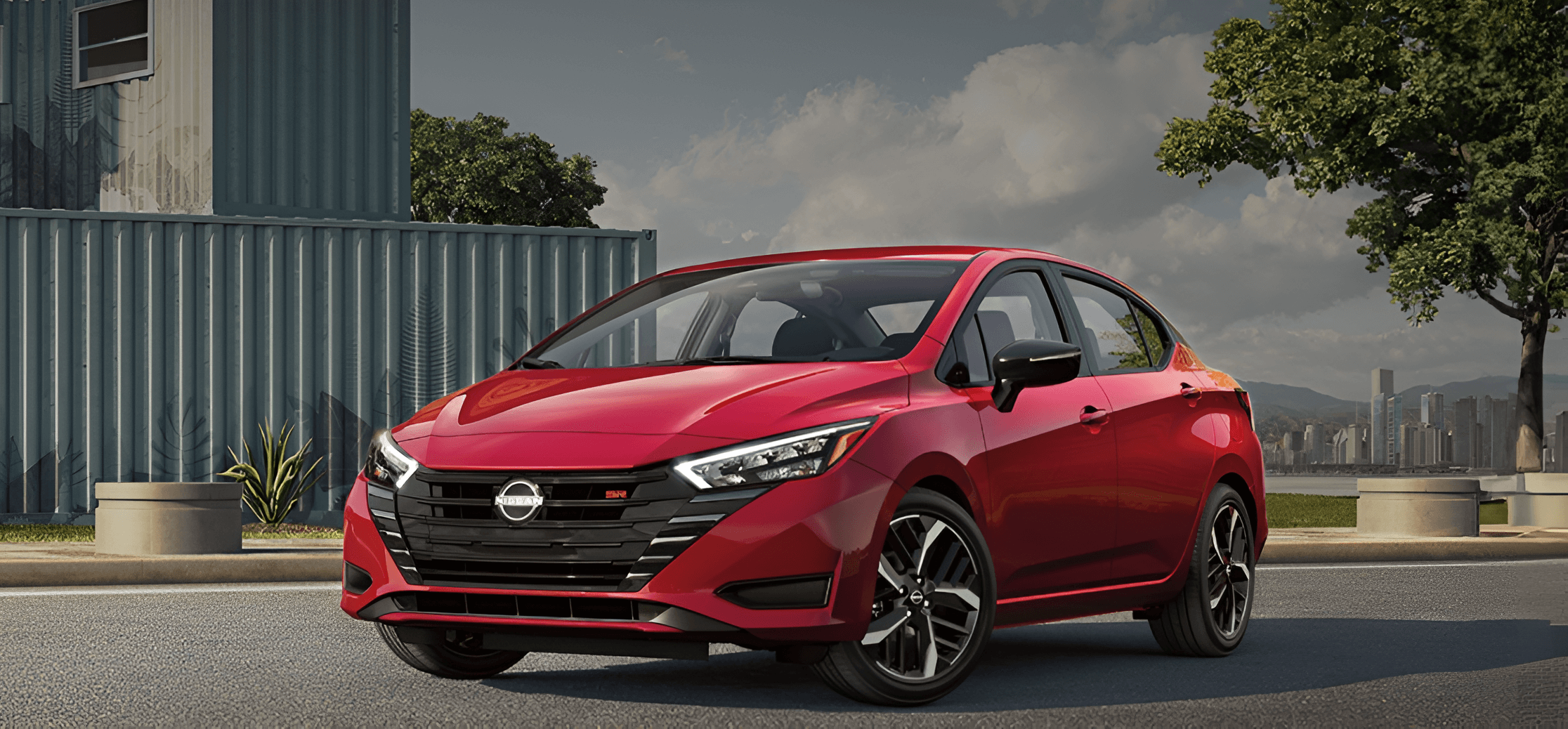

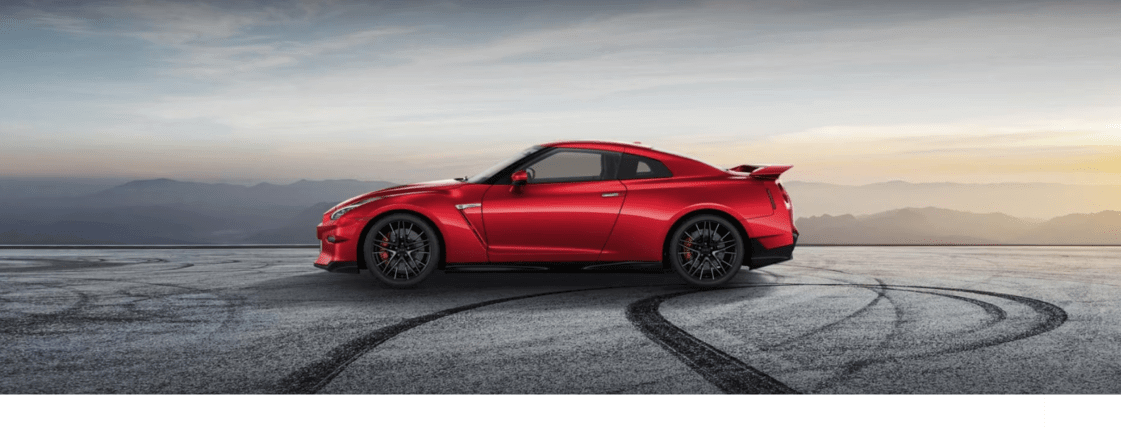

Achieve Your Dreams with Mossy Nissan El Cajon

Remember, the journey to success is not always a straight path, but with clear goals and a determined mindset, you can navigate any challenges that come your way. Embrace the process, celebrate small victories along the way, and stay committed to your objectives. As you achieve each goal, you’ll not only improve your life but also inspire those around you to pursue their own dreams. Start today, set your sights high, and watch as your hard work and dedication lead you to a future filled with accomplishment and fulfillment. At Mossy Nissan El Cajon, we are committed to supporting your journey. Consider upgrading your vehicle to enhance your daily commute or weekend adventures. Visit our New Inventory to explore the latest models, or check out our Pre-owned inventory for great deals on reliable cars. Our Financing options make it easy to find a plan that fits your budget. Don’t miss our Specials offers for additional savings. Ready to take the next step? Schedule a test drive with us today and get one step closer to achieving your goals with a new or pre-owned vehicle from Mossy Nissan El Cajon.